While working with my CEO coach in 2015, he suggested we make it a point to review our working relationship with our current CPA firm. Our CPA firm at the time had worked with us for over a decade. My coach said it was smart business practice to ensure that our CPA firm and my husband and I as an S-Corp were in alignment with our personal, professional, and financial goals. He furthered explained how integral the relationship with our CPA should be to ensure these goals are achieved with professional advice and direction that would allow us to be proactive towards our future. At the time my fear of what we would be hit with in fees, not only from the IRS but the CPA firm itself, was always a great unknown.

We prepared questions for the managing principal of the firm to answer and set up a call with the principal of the firm. Upon receipt of the answers, we quickly realized that the firm was not engaged with us enough to even know our company had doubled in employee size. We discovered that although our relationship with the firm in the beginning of our working relationship was with the principal of the firm himself, over time he had lost touch. In addition, the professionals that did know the most about our account were no longer with the firm. Emotionally, it was not easy for my husband and I to consider going to another firm as we were very fond of our CPA as an individual. After surveying our needs, it became clear to us that a transition was needed for our benefit and the benefit of those that rely on us for their employment.

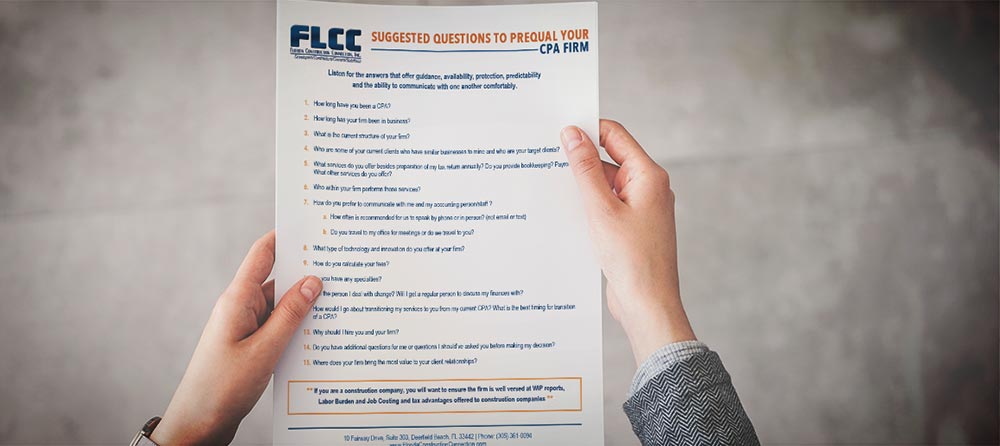

We prepared a list of eight CPA firms to interview who were referred to us by my CEO coach and other business owners who were happy to refer their CPAs. We then proceeded to set up a time to interview each of them by phone first. We prepared a list of questions that we utilized to vet the firms. We then narrowed it down to our top two and met them in person for an additional discussion on what a working relationship and transition to their firm would look like.

The CPA firm we went with stood out among the others. They had a consultative model as opposed to the traditional CPA firm model. They did a great job surveying our needs and proposed a flat monthly fee for agreed upon tax preparation and other services. The monthly service includes a partner from the firm that meets with us in person or over teleconference for set quarterly meetings. He and a colleague from his firm are available by phone and email as needed to answer any questions I or my accounting staff may have in regards to everything financial. The firm also has professionals on staff that specialize in financial and estate planning, insurances, payroll, and pretty much any financial question I may have—business or personal. They are always more than happy to work directly with other relationships that coincide with their services like our banker and financial planner. Our current CPA knows that despite understanding basic financials I am not a CPA and might often need someone to explain tax and other regulations to me in understandable terminology backed by clear action step items with clear deadlines.

The best part about making the change is that I know where we stand ahead of time through real time reporting and projections. The firm has worked with us to set achievable financial projections and currently proactively work side by side with us rather than working to save us from what we did not know we were getting ourselves into. All fear is gone of not knowing if striking a big check to Uncle Sam will be sprung on me or an audit will be around the corner. Nothing is more frustrating than to work hard and make money, only to lose it in a law suit or to the IRS.

I have learned it is smart business practice—whether you think you are satisfied with your CPA firm or not—to do an audit of your relationship with them every couple of years to ensure you are aware of what services they may or may not be providing to you. It doesn’t mean you switch them out, but it does educate you on what services you may need to supplement to achieve your goals. It will also ensure that others within your firm are in alignment with your CPA firm as it pertains to providing the right information in a timely and professional manner to protect your best interest as the owner.

Does your CPA firm offer you a single point of contact that stays in touch to understand your current business model, current volume, business structure, and your goals for this year and the future?

If you answered “I don’t know” or “no” to the above question you could have an unknown risk.

Say “Yay or Nay” to your CPA. Set up a face to face meeting to reacquaint with them and the firm. We have provided a list of questions for you in a download below and we are always here to help with the process.

It isn’t about how big the firm is. It is about the relevancy they offer to you today. Ten years ago, I did not need someone to help me with succession planning. Today I do. Many of my clients need advice on budgeting, contracts from a financial prospective, and cash flow offering them predictability leading to better stability.

What do you need today from your CPA? Are you getting it?

To Financial Peace in the New Year and Always,

Suzanne Breistol

Suzanne,

Amazing timing as I was thinking about changing my CPA. I am also set up as an S-Corp since 2002. Could you give me a few CPA’s that you would recommend?

Also if you get a chance give me a call 305-XXX-XXXX so I can tell you what happened with “XYZ Company” that you put me in touch to meet.

Thanks,

Greg Warren

Hi Greg, I’m glad the timing for this article was just right for you!

I can definitely make recommendations, I will get in touch with you!

Happy Holidays!

Suzanne