How to File for Employee Retention Credit in the Construction Industry

Over a year ago, the CEO of a contracting firm we do business with and I were discussing the Employee Retention Credit (ERC). He mentioned he filed through the company his wife works for and received his money within several months. He also said he could pay for the service after he received his refund. I was surprised as we had to pay when we filed upfront.

Our CPA firm helped us prepare the data, and we filed for our credit through the well-known national Professional Employer Organization (PEO) that manages the payroll and benefits for our company. We filed early, like the above-mentioned client. At the time, I thought we would get our money shortly after filing because so many others were now sharing that they received theirs. After all, the PEO assured us their resources and expertise would be the way to go.

The Company I Wished Helped Us With Our Application – Ready Capital

In the interim while waiting for our money, I met with the other company, Ready Capital, and we decided to write about their offering in our July 2022 blog to educate our subscribers on the ERC program and recommend they go with Ready Capital, as we wished we had done so ourselves.

The Deadline is Extended!

Many of our subscribers took advantage of their program and have already received their monies. The amounts range from $26,000 to close to a million dollars. The original deadline at the time of the original blog was March 2023. The good news for you is that now the deadline has been extended, it’s not too late for your company to apply. The new deadlines are:

- For all quarters of tax year 2020, ERC claims must be filed by April 15, 2024.

- For all quarters of tax year 2021, ERC claims must be filed by April 15, 2025.

Tips for Preparing Data and Filing for the ERC in Construction Management

Here’s What You Need to Know

Congress created the ERC as part of the CARES Act, passed on March 27, 2020. The ERC is a program offered by the IRS that provides a refundable tax credit to eligible employers for wages paid to employees during periods of economic hardship caused by the COVID-19 pandemic. The credit is designed to reward employers who keep employees on their payroll, even if their business operations had been disrupted or suspended because of the pandemic.

Who Can Apply for an ERC?

Businesses that experienced a full or partial suspension of their business operations or significant declines in gross receipts as a result of the pandemic can qualify.

Even if you no longer own the business you owned during the pandemic, you may still qualify for the ERC!

We posted previously in great detail about who can qualify. You can read that post here.

Who Should You Work with to File, and What Are the Costs and Options?

Filing for the ERC can be complicated, which has, in some cases, prevented eligible employers from claiming it.

Ready Capital is the largest publicly traded company (NYSE: RC) offering ERC services, with an approximate market cap of $2 billion. Ready Capital is an established business funding company that has been in operation long before the ERC program began. There are many ERC companies, including the PEOs. We now have verification from my client and others who responded to the blog and used Ready Capital that they have the experience and track record to get it done. The proof is in the timely payout and positive experience with Ready Capital.

Getting Started is Easy!

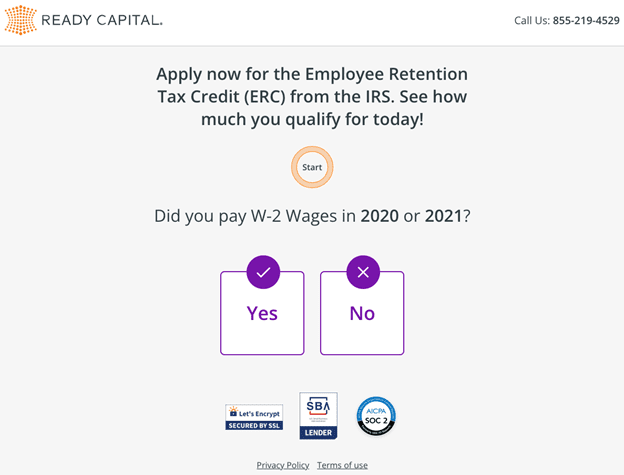

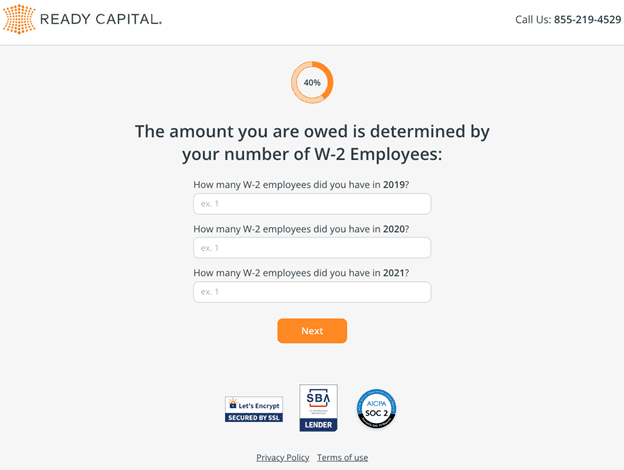

- Click here to access their digital application.

- Answer a few questions and see what you qualify for.

- Provide some required documentation to Ready Capital to complete your application and have it submitted to the IRS.

Why Should You Do It Now When the Deadlines Are Extended So Far Out?

While these deadlines may seem a way off, it is a good idea to get filed ASAP to ensure you can claim your refund. Processing through the IRS after you have applied can sometimes take several months, so the sooner you apply, the sooner you can get this capital back into your business. It is also a government program, and we know these programs are subject to change with time, as you are seeing with this one. Those of you who thought you missed it now have a chance.

Another Reason to Work with Ready Capital for Your ERC

There are many details that must be accounted for to file and receive your ERC in a timely manner. It can take several months to receive your refund from the IRS as it is, but this time can greatly increase if your application is not filed correctly. Making sure your application is created accurately by an expert will ensure your refund is in your hands as quickly as possible. You can trust the experts at Ready Capital to get it done right the first time.

How Much Does It Cost to Work with Ready Capital on My ERC?

Ready Capital offers flexible options, and there is no charge to learn what you qualify for. Once you have learned if you qualify, you can choose between two payment options:

- Pay upfront—10% of your ERC refund amount.

- Pay after you get your credit—15% of your ERC refund amount.

Ready Capital is also a lender, and if you qualify, they have financing options to help you get access to your cash up front.

To get started, click on this link.

Below is a sample of some of the questions that will be asked of you. Their team of professionals will help you along the way if you’re not sure of some of the answers during the application process. You can see they provide a help number on every screen.

Choose the Right Partner to File Your Construction Industry ERC

We made the wrong choice on who to work with and learned that our PEO did not treat us as an individual company and filed our credit in a batch with others. Who knows if the others are the hold up by missing documents, etc.? Even our contact at the PEO can’t tell us. Most likely, we would have our money by now if we worked with Ready Capital and received the individual filing and attention. Many who filed when they applied through our last blog have already received their money. All of the people get regular updates and personal attention from Ready Capital.

So, what are you waiting for? Don’t let time and funding run out! Click this link to get started TODAY!

To Your Money in Your Bank,

Suzanne Breistol