Many of us employers were fortunate to have the PPP assistance during Covid to help us sustain our businesses through all the uncertainty from the pandemic. Now make sure to see if you qualify for the Employee Retention Credit (ERC), a lesser-known stimulus program that could have a bigger impact than PPP without the need for forgiveness.

What is ERC?

ERC was created by Congress as part of the CARES Act, which passed on March 27, 2020.

Who is eligible to apply for ERC?

An eligible employer for ERCs is any private-sector employer or tax-exempt organization carrying on a trade or business during calendar year 2020 or 2021, that either:

- fully or partially suspended operations during any calendar quarter due to orders from an appropriate government authority limiting commerce, travel, or group meetings due to COVID-19; or

- experienced a significant decline in gross receipts (revenues) during the calendar quarter, this is defined as:

- ≥ 50% decline from any calendar quarter in 2019 vs same quarter 2020.

- ≥ 20% decline from any calendar quarter in 2019 vs same quarter 2021.

Employers may also be eligible for the ERC if they experienced more than a nominal Supply Chain Disruption caused by a government order affecting a domestic supplier that caused supplier to suspend shipment.

Employers may also be eligible for the ERC if they were subject to government suspension, and more than a nominal portion of the employer’s business operations was suspended.

For the purposes of the ERC, a portion of an employer’s business is considered more than a nominal portion of operations if either:

- gross receipts (revenues) from that portion of the business were impacted greater than or equal to 10% (determined by same calendar quarter 2019).

- the hours of service performed by employee in that portion of the business is great than or equal to 10% of the total number of hours of service performed by all employees in the employer’s business.

What constitutes a partial suspension of business operations?

- To qualify as partially suspended, an employer’s business operations must have been limited due to a federal, state, or local order, proclamation, or decree that affected the employer’s operations.

- For example, in construction, although a project was estimated and a notice to proceed was issued, if the project was shut down part of the time that would be considered partially suspended operations.

- Partial suspension of business operations could occur because an order limited the number of hours a business could be open, or some business operations had to be closed and work could not be performed remotely.

Am I eligible for ERC due to a Supply Chain Disruption?

- You may qualify for the supply disruption criteria if you had any impact to your materials, deliveries, and/or services from vendors and external parties that delayed, impacted or had some nominal impact on your operations.

Why do you want to see if you qualify?

- For the year 2020 employers can qualify for up to $5,000 per employee and in 2021 for up to $7,000 per employee per quarter for the first 3 quarters of 2021 (i.e. total possible max credit may be up to $26,000 per employee).

- Because the eligibility rules for 2021 are less stringent than those for 2020, many more employers may be eligible for a larger ERC in 2021.

- This is the last impactful stimulus program left, the amount you qualify could be more than both rounds of PPP combined.

Although generous, the ERC is also complicated, which has, in some cases, prevents eligible employers from claiming it. We are happy to provide an introduction to Ready Capital as a resource to help you with filing.

Ready Capital is a publicly traded company (NYSE:RC), with approximate market cap of $2B. They will provide a template and a representative to help you determine if you qualify and are eligible based on the above criteria. Ready Capital is an established funding company and they have been in operation long before ERC began. They did not simply start their operation just to process ERC. Ready Capital has over 600 skilled financial professionals that have processed over 160,000 applications for over 7 billion in financial requests.

- Finding out if you qualify is risk free. If you don’t qualify, there is no fee. Their motto is simply this: “If you don’t get paid, we don’t get paid.” Ready Capital provides two payment options to calculate, process and file for your ERC credit. The two payment options are: Pay up front (Cheapest Option) – 10%.

- Pay us when you get your credit – 15%.

Ready Capital is also a lender and, if you qualify, they have financing options to help you get access to your cash up front.

In order to get started click on this link Ready Capital ERC.

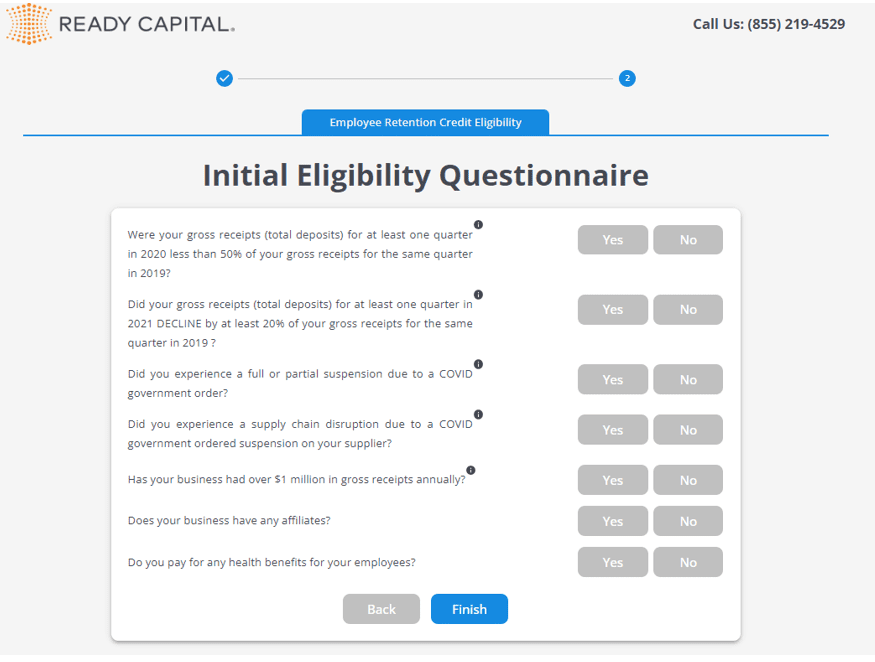

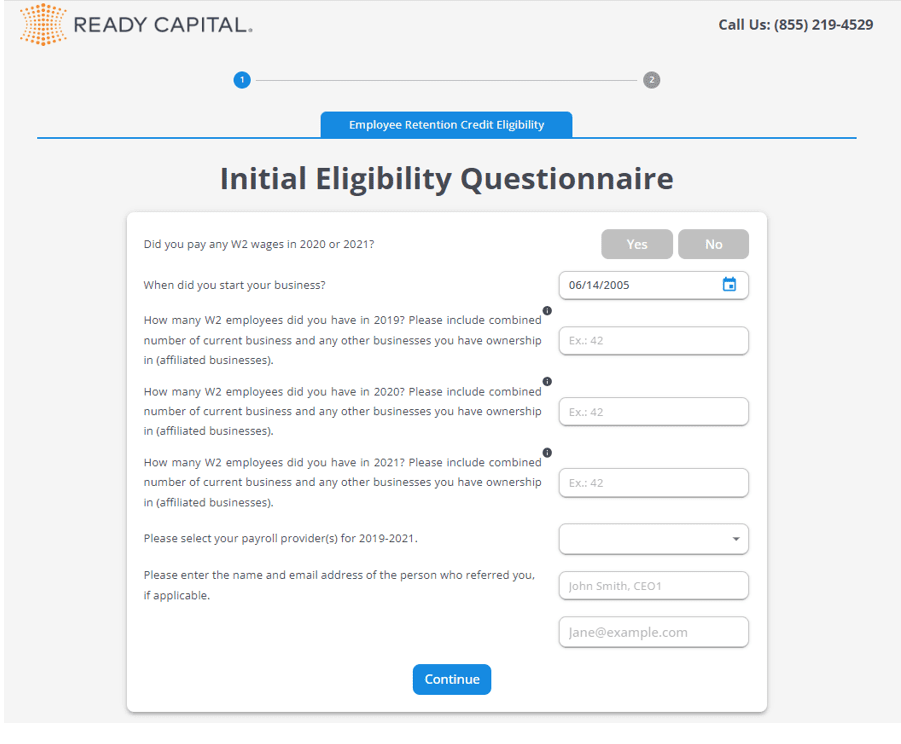

Below is a sample of some of the questions that will be asked of you. If eligible, Ready Capital will ask some questions regarding PPP, information on any government shutdowns and supply chain disruptions your business encountered. Their team of professionals will help you along the way if you’re not sure of some of the answers during the application process. You can see they provide a help number on every screen.

So, what are you waiting for? Time and funding is running out! Click this link Ready Capital ERC to get started TODAY!

So, what are you waiting for? Time and funding is running out! Click this link Ready Capital ERC to get started TODAY!

To Your ERC Payment,

Suzanne Breistol

Will there be an ERC for the year of 2022

Jeffrey please contact Katy at Knight Capital Funding as they are the experts on the programs and the program dates. 855-219-4529.

We can only publish what we already know is in progress. Thank you for being a blog subscriber.