by Christopher T. Marrie, HBK CPAs & Consultants

Cost accumulation and management is critical to a strong financial reporting system in any industry. For construction contractors of any size it is one of the most essential functions of the business. Proper job costing not only impacts revenue recognition but also the contractor’s cash flow and profitability.

To reduce the risks of estimating it is important the contractor develop cost accumulation and allocation methods that provide comparable data between actual costs and estimated costs. The job costing process should capture all direct and indirect costs for individual contracts.

Accumulation of direct costs such as direct labor, materials and subcontractor charges are easily identified to a specific contract. Indirect overhead costs, however, can be more challenging and complex to track and allocate. When developing a system to properly allocate indirect costs (indirect labor, fringe benefits, payroll taxes, rent, etc.) the contractor should determine what costs should be included in the allocation pool and implement a consistent and rational methodology for allocation to individual contracts.

The most common approach to allocating overhead involves using overhead burden rates. A burden rate is calculated by dividing total overhead by the total of the allocation base selected, which is often total direct labor costs. This burden rate is then applied to the allocation base for each contract to arrive at the amount of overhead to be allocated to the contract.

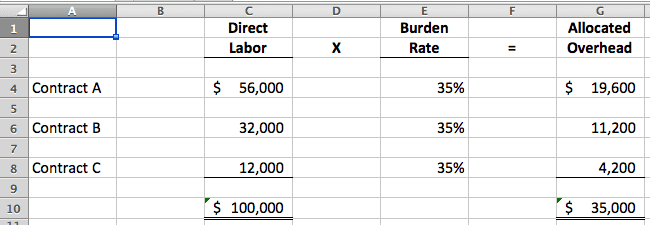

Example Allocation of $35,000 of Overhead

Allocation Based on $100,000 of Direct Labor Costs

Burden Rate: $35,000 / $100,000 = 35%

Once a consistent methodology is in place it is critical the contractor benchmark their overhead costs against others in their industry segment. This will allow for proper cost controls on overhead as well as give the contractor timely and useful financial information that can be used to reduce expenditures as needed before cash flow is negatively impacted. Some examples of common benchmarks for “best-in-class” contractors is keeping overhead costs before bonuses below 5% of total revenue and maintaining at least 6 months of overhead costs in backlog gross profit.

If you have any questions regarding this topic or financial simplicity for your business please contact Christopher Marrie at 239-331-6797.